'The measurement of performance in a not-for-profit organisation may have value for money as its focus.’

Expand on this statement, incorporating comments on economy, efficiency and effectiveness into your answer.

***************

Since profit is not available as a performance measure in a non-profit-making organisation, other performance measures need to be considered. The value for money principle should ensure that the service is provided for minimum cost, or that the maximum benefit is achieved by the users of the service for the sum of money provided to fund the service organisation.

The principles of economy, efficiency and effectiveness would all seem to be desirable under such circumstances, but can sometimes provide conflicting decisions as follows:

• economy – using the least cost option to provide a requirement

• efficiency – maximising the ratio of output to input

• effectiveness – the extent to which objectives are achieved.

By purchasing a cheap component for a system, we may achieve economy and, by producing an output at an increased level due to the reduced cost involved, we have achieved efficiency, but if the quality is poor then the effectiveness objective is not achieved.

As an example, consider a charity that aims to provide an opthalmic service to a third world country and issue glasses where necessary to the population. By issuing cheap glasses (economy), more of the population can be assisted (efficiency), but if there is a high incidence of breakage and the glasses prove to be of little or no use then effectiveness is not achieved.

Therefore, all three ‘tests’ should be considered when assessing value for money.

************

Information to assist your study of Management Theories and Principles more interesting

Sunday, December 25, 2011

Tuesday, October 18, 2011

Another aspect of Benchmarking

Benchmarking is a business improvement technique. There are different types of benchmarking.

The aim of benchmarking is to identify where best practice lies and then to analyse what constitutes the best operational practice so this can be implemented across the business.

*************

Methods of Benchmarking

1. Internal benchmarking is where similar operations in different parts of the company under consideration are compared with each other and also with an internally generated target.

2. External benchmarking is where the company’s results are compared to those of other companies.

*************

There are different types of external benchmarking:

**one where competitors are used as comparators and

**another where a company with similar operations (eg warehousing), which is not a direct competitor, is compared.

*************

The main advantages and disadvantages concern the availability of benchmark information and its applicability to the business.

Internal comparison between regions in a group of companies will be easy but may not yield dramatic improvements as the regions are probably already in relatively close contact. Any improvements identified from this exercise should be easily applicable as the systems will be broadly the same.

External benchmarking in this case means comparison to competitors where the possibility of radical new ideas is greater but the difficulty will lie in obtaining sufficiently detailed information to identify the best practice business process. Of course, it will be difficult to negotiate an information sharing arrangement with a competitor due to the commercially sensitive data being exchanged. However, there exist some government schemes which require subscriber companies to supply data and then provide them with anonymised industry data in return.

It would be easier to obtain information from a company which is not in direct competition with the company but which has similar functions such as purchasing and warehousing. However, there are likely to be more significant differences in the objectives and functions of the activities being compared and so it may be harder to apply the lessons from the competitor to the company’s operations.

************

The aim of benchmarking is to identify where best practice lies and then to analyse what constitutes the best operational practice so this can be implemented across the business.

*************

Methods of Benchmarking

1. Internal benchmarking is where similar operations in different parts of the company under consideration are compared with each other and also with an internally generated target.

2. External benchmarking is where the company’s results are compared to those of other companies.

*************

There are different types of external benchmarking:

**one where competitors are used as comparators and

**another where a company with similar operations (eg warehousing), which is not a direct competitor, is compared.

*************

The main advantages and disadvantages concern the availability of benchmark information and its applicability to the business.

Internal comparison between regions in a group of companies will be easy but may not yield dramatic improvements as the regions are probably already in relatively close contact. Any improvements identified from this exercise should be easily applicable as the systems will be broadly the same.

External benchmarking in this case means comparison to competitors where the possibility of radical new ideas is greater but the difficulty will lie in obtaining sufficiently detailed information to identify the best practice business process. Of course, it will be difficult to negotiate an information sharing arrangement with a competitor due to the commercially sensitive data being exchanged. However, there exist some government schemes which require subscriber companies to supply data and then provide them with anonymised industry data in return.

It would be easier to obtain information from a company which is not in direct competition with the company but which has similar functions such as purchasing and warehousing. However, there are likely to be more significant differences in the objectives and functions of the activities being compared and so it may be harder to apply the lessons from the competitor to the company’s operations.

************

Target Costing and Its Application

Target costing should be viewed as an integral part of a strategic profit management system.

The initial consideration in target costing is the determination of an estimate of the selling price for a new product which will enable a firm to capture its required share of the market. Then it is necessary to reduce this figure to reflect the firm’s desired level of profit, having regard to the rate of return required on new capital investment and working capital requirements.

The deduction of required profit from the proposed selling price will produce a target price that must be met in order to ensure that the desired rate of return is obtained.

Thus the main theme that underpins target costing can be seen to be 'what should a product cost in order to achieve the desired level of return’.

Target costing will necessitate comparison of current estimated cost levels against the target level which must be achieved if the desired levels of profitability, and hence return on investment, are to be achieved. Thus where a gap exists between the current estimated cost levels and the target cost, it is essential that this gap be closed.

Example:

The Marketing Director of Company A has estimated that sales volume amounting to 5% of the total market size can be achieved in year 1 if a selling price of £80 per unit is maintained throughout the year. The board of directors are in agreement that they wish to maintain a 5% share by volume, of the total market size in each of years 2–4.

The management of Company A should be cognisant of the fact that it is far easier to ‘design out’ cost during the pre-production phase than to ‘control out’ cost during the production phase. Thus cost reduction at this stage of a product’s life cycle is of critical significance to business success. A number of techniques may be employed in order to help in the achievement and maintenance of the desired level of target cost. Attention should be focused upon the identification of value added and non-value added activities with the aim of the elimination of the latter. The product should be developed in an atmosphere of ‘continuous improvement’. In this regard, Total Quality techniques such as the use of Quality circles may be used in attempting to find ways of achieving reductions in product cost.

Value engineering techniques can be used to evaluate necessary product features such as the quality of materials used. It is essential that a collaborative approach is used by the management of Company A and that all interested parties such as suppliers and customers are closely involved in order to engineer product enhancements at reduced cost.

**********

The initial consideration in target costing is the determination of an estimate of the selling price for a new product which will enable a firm to capture its required share of the market. Then it is necessary to reduce this figure to reflect the firm’s desired level of profit, having regard to the rate of return required on new capital investment and working capital requirements.

The deduction of required profit from the proposed selling price will produce a target price that must be met in order to ensure that the desired rate of return is obtained.

Thus the main theme that underpins target costing can be seen to be 'what should a product cost in order to achieve the desired level of return’.

Target costing will necessitate comparison of current estimated cost levels against the target level which must be achieved if the desired levels of profitability, and hence return on investment, are to be achieved. Thus where a gap exists between the current estimated cost levels and the target cost, it is essential that this gap be closed.

Example:

The Marketing Director of Company A has estimated that sales volume amounting to 5% of the total market size can be achieved in year 1 if a selling price of £80 per unit is maintained throughout the year. The board of directors are in agreement that they wish to maintain a 5% share by volume, of the total market size in each of years 2–4.

The management of Company A should be cognisant of the fact that it is far easier to ‘design out’ cost during the pre-production phase than to ‘control out’ cost during the production phase. Thus cost reduction at this stage of a product’s life cycle is of critical significance to business success. A number of techniques may be employed in order to help in the achievement and maintenance of the desired level of target cost. Attention should be focused upon the identification of value added and non-value added activities with the aim of the elimination of the latter. The product should be developed in an atmosphere of ‘continuous improvement’. In this regard, Total Quality techniques such as the use of Quality circles may be used in attempting to find ways of achieving reductions in product cost.

Value engineering techniques can be used to evaluate necessary product features such as the quality of materials used. It is essential that a collaborative approach is used by the management of Company A and that all interested parties such as suppliers and customers are closely involved in order to engineer product enhancements at reduced cost.

**********

Tuesday, September 20, 2011

Internal Control

Explanation of Internal Control

‘The process designed and effected by those charged with governance, management and other personnel to provide reasonable assurance about the achievement of the entity’s objectives with regard to reliability of financial reporting, effectiveness and efficiency of operations and compliance with applicable laws and regulations.

Internal control consists of the following components:

(a) The control environment;

(b) The entity’s risk assessment process;

(c) The information system, including the related business processes, relevant to financial reporting, and communication;

(d) Control activities; and

(e) Monitoring of controls.’

Examples of internal controls:

• Division of duties

• Accounting

• Management

• Physical

• Supervision

• Organisation

• Authorisation, and

• Personnel

************

‘The process designed and effected by those charged with governance, management and other personnel to provide reasonable assurance about the achievement of the entity’s objectives with regard to reliability of financial reporting, effectiveness and efficiency of operations and compliance with applicable laws and regulations.

Internal control consists of the following components:

(a) The control environment;

(b) The entity’s risk assessment process;

(c) The information system, including the related business processes, relevant to financial reporting, and communication;

(d) Control activities; and

(e) Monitoring of controls.’

Examples of internal controls:

• Division of duties

• Accounting

• Management

• Physical

• Supervision

• Organisation

• Authorisation, and

• Personnel

************

Sunday, August 21, 2011

Qualitative characteristics of information on Risk and Internal Controls needed by the Board

The information on risks and internal controls should be high quality information. This means that it enables the full information content to be conveyed to the board in a manner that is clear and has nothing in it that would make any part of it difficult to understand. Communications should be reliable, relevant and understandable. They should also be complete.

By reliable means the trustworthiness of the information: the assumption that it is ‘hard’ information, that it is correct, that it is impartial, unbiased and accurate. Even In the event of conveying bad news.

By relevant means not only that due reports should be complete and delivered promptly, but also that anything that that should be brought to the board’s attention, should be brought to the board’s attention while there is still time for them to do something about it.

Not all directors possess the technical and nautical knowledge of senior operating personnel of the company. It is therefore particularly important that information conveyed is understandable. This means that it should contain a minimum of technical terms that have obvious meaning to operating managers but may not be understandable to a non-specialist. All communication should therefore be as plain as possible within the constraints of reliability and completeness.

By complete means that all information that the directors need to know and which the operating managers have access to, should be included, regardless of

any inconvenience that it may cause to one or more colleagues.

**********

The importance for the board of directors to have all the information

The importance for the board of directors to have all the information relating to key operational internal controls and risks

1. In the first instance, the information provided enables the board to monitor the performance of the company on the crucial issues. This includes compliance, performance against targets and the effectiveness of existing controls. By being made aware of the key risks and internal control issues at the operational level, the board can work to address them in the most appropriate way.

2. The board also needs to be aware of the business impact of operational controls and risks to enable the board to make informed business decisions at the strategic level. If the board is receiving incomplete, defective or partial information then they will not be in full possession of the necessary facts to allocate resources in the most effective and efficient way possible.

3. The board has the responsibility to provide information about risks and internal controls to external audiences. Best practice reporting means that directors have to provide information to shareholders and others, about the company’s systems, controls, targets, levels of compliance and improvement measures and hence quality information are needed to achieve this.

***********

1. In the first instance, the information provided enables the board to monitor the performance of the company on the crucial issues. This includes compliance, performance against targets and the effectiveness of existing controls. By being made aware of the key risks and internal control issues at the operational level, the board can work to address them in the most appropriate way.

2. The board also needs to be aware of the business impact of operational controls and risks to enable the board to make informed business decisions at the strategic level. If the board is receiving incomplete, defective or partial information then they will not be in full possession of the necessary facts to allocate resources in the most effective and efficient way possible.

3. The board has the responsibility to provide information about risks and internal controls to external audiences. Best practice reporting means that directors have to provide information to shareholders and others, about the company’s systems, controls, targets, levels of compliance and improvement measures and hence quality information are needed to achieve this.

***********

Advantages and Disadvantages of Risk Committee made up of NEDs

The UK Combined Code, for example, allows for risk committees to be made up of either executive or non-executive members.

Advantages of non-executive membership

1. Separation and detachment from the content being discussed is more likely to bring independent scrutiny. Sensitive issues relating to one or more areas of executive oversight can be aired without vested interests being present.

2. Non-executive directors often bring specific expertise that will be more relevant to a risk problem than more operationally-minded executive directors will have. The NEDs, being from different backgrounds, are likely to bring a range of perspectives and suggested strategies which may enrich the options open to the committee when considering specific risks.

Disadvantages of non-executive membership (advantages of executive membership)

1. Direct input and relevant information would be available from executives working directly with the products, systems and procedures being discussed if they were on the committee. Non-executives are less likely to have specialist knowledge of products, systems and procedures being discussed and will therefore be less likely to be able to comment intelligently during meetings.

2. Non-executive directors will need to report their findings to the executive board. This reporting stage slows down the process, thus requiring more time before actions can be implemented, and introducing the possibility of some misunderstanding.

***********

Advantages of non-executive membership

1. Separation and detachment from the content being discussed is more likely to bring independent scrutiny. Sensitive issues relating to one or more areas of executive oversight can be aired without vested interests being present.

2. Non-executive directors often bring specific expertise that will be more relevant to a risk problem than more operationally-minded executive directors will have. The NEDs, being from different backgrounds, are likely to bring a range of perspectives and suggested strategies which may enrich the options open to the committee when considering specific risks.

Disadvantages of non-executive membership (advantages of executive membership)

1. Direct input and relevant information would be available from executives working directly with the products, systems and procedures being discussed if they were on the committee. Non-executives are less likely to have specialist knowledge of products, systems and procedures being discussed and will therefore be less likely to be able to comment intelligently during meetings.

2. Non-executive directors will need to report their findings to the executive board. This reporting stage slows down the process, thus requiring more time before actions can be implemented, and introducing the possibility of some misunderstanding.

***********

Importance of independence of Auditor

The auditor must be materially independent of the client for the following reasons:

1. To increase credibility and to underpin confidence in the process. In an external audit, this will primarily be for the benefit of the shareholders and in an internal audit, it will often be for the audit committee that is, in turn, the recipient of the internal audit report.

2. To ensure the reliability of the audit report. Any evidence of lack of independence (or ‘capture’) has the potential to undermine all or part of the audit report thus rendering the exercise flawed.

3. To ensure the effectiveness of the investigation of the process being audited. An audit, by definition, is only effective as a means of interrogation if the parties are independent of each other.

***********

Framework for assessing risk

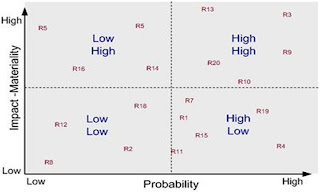

Risk is assessed by considering each identified risk in terms of two variables:

– its hazard (or consequences or impact) and,

– its probability of happening (or being realised or ‘crystallising’).

The most material risks are those identified as having high impact/hazard and the highest probability of happening. Risks with low hazard and low probability will have low priority whilst between these two extremes are situations where judgement is required on how to manage the risk.

In practice, it is difficult to measure both variables with any degree of certainty and so it is often sufficient to consider each in terms of relative crude metrics such as ‘high/medium/low’ or even ‘high/low’. The framework can be represented as a ‘map’ of two intersecting continuums with each variable being plotted along a continuum.

***********

Contribution of Risk Committee

Evaluate the contribution that a risk committee made up of non-executive directors could make to shareholders’ confidence in the management of an organistion

Risk committees are considered best practice by most corporate governance regimes around the world for a number of reasons. A risk committee made up of non-executive directors could provide an independent viewpoint on the company’s overall response to risk, and to challenge the CEO’s attitude. A risk committee can help increase the confidence in a number of ways:

Determining overall exposure to risk

The committee can pressure the board to determine what constitute acceptable level of risk, bearing in mind the likelihood and the risks materialising and the company’s ability to reduce the incidence and impact on the business.

Monitoring the overall exposure to risk

Once the board defined acceptable risk levels, the committee should monitor whether the company is remaining within these levels and whether earnings are sufficient given the levels of risks that are being borne.

Reviewing reports on key risks

There should be a regular system of reports to the risk management committee covering areas known to be of high risk, also one-off reports covering conditions and events likely to arise in the near future. This should facilitate monitoring of risk.

Monitoring the effectiveness of the risk management systems

The committee should monitor the effectiveness of the risk management systems, focusing particularly on effective management attitudes towards risks and the overall control environment and culture. A risk committee can judge whether there is an emphasis on effective management or whether insufficient attention is being given to risk management due to the pursuit of higher returns.

************

Risk committees are considered best practice by most corporate governance regimes around the world for a number of reasons. A risk committee made up of non-executive directors could provide an independent viewpoint on the company’s overall response to risk, and to challenge the CEO’s attitude. A risk committee can help increase the confidence in a number of ways:

Determining overall exposure to risk

The committee can pressure the board to determine what constitute acceptable level of risk, bearing in mind the likelihood and the risks materialising and the company’s ability to reduce the incidence and impact on the business.

Monitoring the overall exposure to risk

Once the board defined acceptable risk levels, the committee should monitor whether the company is remaining within these levels and whether earnings are sufficient given the levels of risks that are being borne.

Reviewing reports on key risks

There should be a regular system of reports to the risk management committee covering areas known to be of high risk, also one-off reports covering conditions and events likely to arise in the near future. This should facilitate monitoring of risk.

Monitoring the effectiveness of the risk management systems

The committee should monitor the effectiveness of the risk management systems, focusing particularly on effective management attitudes towards risks and the overall control environment and culture. A risk committee can judge whether there is an emphasis on effective management or whether insufficient attention is being given to risk management due to the pursuit of higher returns.

************

Saturday, August 20, 2011

Appointment of Internal Auditors from Inside or Outside

In practice, a decision such as this one will depend on a number of factors including the supply of required skills in the internal and external job markets. In constructing the case for an external appointment, however, the following points can be made.

Primarily, an external appointment would bring detachment and independence that would be less likely with an internal one.

Firstly, then, an external appointment would help with independence and objectivity (avoiding the possibility of auditor capture). He or she would owe no personal loyalties nor ‘favours’ from previous positions. Similarly, he or she would have no personal grievances nor conflicts with other people from past disputes or arguments.

Some benefit would be expected from the ‘new broom’ effect in that the appointment would see the company through fresh eyes. He or she would be unaware of vested interests. He or she would be likely to come in with new ideas and expertise gained from other situations.

Finally, as with any external appointment, the possibility exists for the transfer of best practice in from outside – a net gain in knowledge for the company.

***********

Primarily, an external appointment would bring detachment and independence that would be less likely with an internal one.

Firstly, then, an external appointment would help with independence and objectivity (avoiding the possibility of auditor capture). He or she would owe no personal loyalties nor ‘favours’ from previous positions. Similarly, he or she would have no personal grievances nor conflicts with other people from past disputes or arguments.

Some benefit would be expected from the ‘new broom’ effect in that the appointment would see the company through fresh eyes. He or she would be unaware of vested interests. He or she would be likely to come in with new ideas and expertise gained from other situations.

Finally, as with any external appointment, the possibility exists for the transfer of best practice in from outside – a net gain in knowledge for the company.

***********

Objectivity and Internal/External Auditors

Objectivity is a state or quality that implies detachment, lack of bias, not influenced by personal feelings, prejudices or emotions. It is a very important quality in corporate governance generally and especially important in all audit situations where, regardless of personal feeling, the auditor must carry out his or her task objectively and with the purpose of the audit uppermost in mind. The IFAC Code of Ethics explains objectivity in the following terms (Introduction, clause 16): “… fair and should not allow prejudice or bias, conflict of interest or influence of others to override objectivity.”

It thus follows that characteristics that might demonstrate an internal auditor’s professional objectivity will include fairness and even-handedness, freedom from bias or prejudice and the avoidance of conflicts of interest (e.g. by accepting gifts, threats to independence, etc.).

The internal auditor should remember at all times that the purpose is to deliver a report on the systems being audited to his or her principal. In an external audit situation, the principal is ultimately the shareholder and in internal audit situations, it is the internal audit committee (and then ultimately, shareholders).

************

It thus follows that characteristics that might demonstrate an internal auditor’s professional objectivity will include fairness and even-handedness, freedom from bias or prejudice and the avoidance of conflicts of interest (e.g. by accepting gifts, threats to independence, etc.).

The internal auditor should remember at all times that the purpose is to deliver a report on the systems being audited to his or her principal. In an external audit situation, the principal is ultimately the shareholder and in internal audit situations, it is the internal audit committee (and then ultimately, shareholders).

************

Monday, August 15, 2011

Classification of Stakeholders

(a) Internal stakeholders

Employees, management

(b) External stakeholders

The government, local government, the public, pressure groups, opinion leaders

(c) Connected stakeholders

Shareholders, customers, suppliers, lenders, trade unions, competitors

***************

(a) Direct stakeholders

Those who know they can affect or are affected by the organisation’s activities – employees, major customers and suppliers

(b) Indirect stakeholders

Those who are unaware of the claims they have on the organization or who cannot express their claim directly- wildlife, individual customers or suppliers of a large organization, future generations

*************

(a) Narrow stakeholders

Those most affected by organisation’s strategy- shareholders, managers, employees, suppliers, dependent customers

(b) Wide stakeholders

Those less affected by the organisation’s strategy – government, less dependent customers, the wider community

************

(a) Primary stakeholders

Those without whose participation the organization will have difficulty continuing as a going concern, such as customers, suppliers and government (tax and legislation)

(b) Secondary stakeholders

Those whose loss of participation won’t affect the company’s continued existence such as broad communities

*************

(a) Active stakeholders

Those who seek to participate in the organisation’s activities. Stakeholders includes managers, employees and institutional investors, but may also include other groups not part of an organization’s structure such as regulators or pressure group

(b) Passive stakeholders

Those who do not seek to participate in policy-making such as most shareholders, local communities and government

**************

(a) Voluntary stakeholders

Those who engage with the organization voluntarily – employees, most customers, suppliers and shareholders

(b) Involuntary stakeholders

Those who become stakeholders involuntarily – local communities, neighbours, the natural world, future generations

**************

(a) Legitimate stakeholders

Those who have valid claims upon the organisation

(b) Illegitimate stakeholders

Those whose claims upon the organization are not valid

**************

(a) Recognized stakeholders

Those whose interests and views managers consider when deciding upon strategy

(b) Unrecognized stakeholders

Those whose claims aren’t taken into account in the organisation’s decision making – likely to be very much the same as illegitimate stakeholders

**************

(a) Known stakeholders

Those whose existence is known o the organisation

(b) Unknown stakeholders

Those whose existence is unknown to the organisation (undiscovered species, communities in proximity to overseas suppliers)

*************

Employees, management

(b) External stakeholders

The government, local government, the public, pressure groups, opinion leaders

(c) Connected stakeholders

Shareholders, customers, suppliers, lenders, trade unions, competitors

***************

(a) Direct stakeholders

Those who know they can affect or are affected by the organisation’s activities – employees, major customers and suppliers

(b) Indirect stakeholders

Those who are unaware of the claims they have on the organization or who cannot express their claim directly- wildlife, individual customers or suppliers of a large organization, future generations

*************

(a) Narrow stakeholders

Those most affected by organisation’s strategy- shareholders, managers, employees, suppliers, dependent customers

(b) Wide stakeholders

Those less affected by the organisation’s strategy – government, less dependent customers, the wider community

************

(a) Primary stakeholders

Those without whose participation the organization will have difficulty continuing as a going concern, such as customers, suppliers and government (tax and legislation)

(b) Secondary stakeholders

Those whose loss of participation won’t affect the company’s continued existence such as broad communities

*************

(a) Active stakeholders

Those who seek to participate in the organisation’s activities. Stakeholders includes managers, employees and institutional investors, but may also include other groups not part of an organization’s structure such as regulators or pressure group

(b) Passive stakeholders

Those who do not seek to participate in policy-making such as most shareholders, local communities and government

**************

(a) Voluntary stakeholders

Those who engage with the organization voluntarily – employees, most customers, suppliers and shareholders

(b) Involuntary stakeholders

Those who become stakeholders involuntarily – local communities, neighbours, the natural world, future generations

**************

(a) Legitimate stakeholders

Those who have valid claims upon the organisation

(b) Illegitimate stakeholders

Those whose claims upon the organization are not valid

**************

(a) Recognized stakeholders

Those whose interests and views managers consider when deciding upon strategy

(b) Unrecognized stakeholders

Those whose claims aren’t taken into account in the organisation’s decision making – likely to be very much the same as illegitimate stakeholders

**************

(a) Known stakeholders

Those whose existence is known o the organisation

(b) Unknown stakeholders

Those whose existence is unknown to the organisation (undiscovered species, communities in proximity to overseas suppliers)

*************

Friday, August 12, 2011

Risk awareness

Explanation

Risk awareness is a capability of an organisation to be able to recognise risks when they arise, from whatever source they may come. A culture of risk awareness suggests that this capability (or competence) is present throughout the organisation and is woven into the normal routines, rituals, ways of thinking and is taken-for-granted in all parts of the company and in all employees.

***********

Why is it necessary for organisation to cultivate a culture of risk awareness and that this should permeate all levels of the company?

Risks can arise in any part of the organisation and at any level. Not all risks are at the strategic level and can be captured by a risk assessment. A culture of risk awareness will help ensure that all employees are capable of identifying risks as and when they arise.

Risks are dynamic and rise and fall with changes in the business environment and with changes in the company’s activities. With changes to the company’s risk profile occurring all the time, it cannot be assumed that the risks present at the most recent risk assessment will remain the same. Being prepared to adapt to changes is a key advantage of a culture of risk awareness.

A lack of risk awareness is often evidence of a lack of risk management strategy in the organisation. This, in turn, can be dangerous as the company could be more exposed to risk than it need be because of the lack of attentiveness by staff. A lack of effectiveness of risk management strategy leaves the company vulnerable to unrecognised or wrongly assessed risks.

**********

Risk awareness is a capability of an organisation to be able to recognise risks when they arise, from whatever source they may come. A culture of risk awareness suggests that this capability (or competence) is present throughout the organisation and is woven into the normal routines, rituals, ways of thinking and is taken-for-granted in all parts of the company and in all employees.

***********

Why is it necessary for organisation to cultivate a culture of risk awareness and that this should permeate all levels of the company?

Risks can arise in any part of the organisation and at any level. Not all risks are at the strategic level and can be captured by a risk assessment. A culture of risk awareness will help ensure that all employees are capable of identifying risks as and when they arise.

Risks are dynamic and rise and fall with changes in the business environment and with changes in the company’s activities. With changes to the company’s risk profile occurring all the time, it cannot be assumed that the risks present at the most recent risk assessment will remain the same. Being prepared to adapt to changes is a key advantage of a culture of risk awareness.

A lack of risk awareness is often evidence of a lack of risk management strategy in the organisation. This, in turn, can be dangerous as the company could be more exposed to risk than it need be because of the lack of attentiveness by staff. A lack of effectiveness of risk management strategy leaves the company vulnerable to unrecognised or wrongly assessed risks.

**********

Why risk assessment is dynamic

Risk assessment is a dynamic management activity because of changes in the organisational environment and because of changes in the activities and operations of the organisation which interact with that environment.

A risk may arise from a change in the activity of the company: a new product launch. The new product may introduce a new risk that was not present prior to the new product. It may be a potential liability from the use of the product or a potential loss from the materials used in its production, for example.

Changes in the environment might include changes in any of the PEST (political, economic, social, technological) or any industry level change such as a change in the competitive behaviour of suppliers, buyers or competitors. In either case, new risks can be introduced, existing ones can become more likely or have a higher impact, or the opposite (they may disappear or become less important). Risk may arise from a change in legislation which is a change in the external environment.

************

A risk may arise from a change in the activity of the company: a new product launch. The new product may introduce a new risk that was not present prior to the new product. It may be a potential liability from the use of the product or a potential loss from the materials used in its production, for example.

Changes in the environment might include changes in any of the PEST (political, economic, social, technological) or any industry level change such as a change in the competitive behaviour of suppliers, buyers or competitors. In either case, new risks can be introduced, existing ones can become more likely or have a higher impact, or the opposite (they may disappear or become less important). Risk may arise from a change in legislation which is a change in the external environment.

************

Why is Auditor Independence Important?

(1) Reliability of financial information

• Reliability of financial information is a key aspect of Corporate Governance.

• S/H and other stakeholders need a trustworthy record of directors’ stewardship to be able to take decision about company.

• Assurance provided by Auditors is a key quality control on the reliability of information.

(2) Credibility of financial information

• An unqualified report by independent external auditors on the account should give credibility and enhance the appeal of the company to investors.

• This unqualified report should represent the views of independent experts who are not motivated by personal interests to give a favourable opinion.

(3) Value for money of audit work

• A lack of independence seems to mean that important audit work may not be done, and thus shareholders are not receiving value for the audit fees.

(4) Threats to professional standards

• A lack of independence may lead to a failure to fulfill professional requirements to obtain enough evidence to form the basis of an audit opinion, in this case, to obtain details of a questionable material item.

• Failure by auditors to do this undermines the credibility of the accountancy profession and standards it enforces.

*********

Organisational Culture

A pattern of shared basic assumptions that was learned by a group as it solved its problems of external adaptation and internal integration, that has worked well enough to be considered valid and, there fore, to be taught to new members as the correct way to perceive, think and feel in relation to those problems.

1. It is an acceptable way of thinking and acting that is embedded into processes and people.

2. It tends to be driven top down but can also shift and change without strong leadership.

3. It shapes attitudes of staff towards objectives of growth, return and risk, and their attitude towards economic, social and environmental objectives and to ethics and morality.

4. The right culture can promote business success so that agreed objectives are more likely to be met.

5. It can be managed. Good management creates culture that supports company objective.

6. The stance or perceived stance of a company, in terms of attitudes to stakeholders and their interests is a crucial part of a company culture.

7. The implication of the concept of company culture is there may be separate culture for management and staff. These cultures need to be aligned to achieve company objectives.

8. It is composed of many interrelated and sometimes conflicting objectives and values. Some companies focus on profit, others on the 3 Ps = People, Planet and Profits.

********

Stakeholders

Definition

There are a number of definitions of a stakeholder. Freeman (1984), for example, defined a stakeholder in terms of any organisation or person that can affect or be affected by the policies or activities of an entity. Hence stakeholding can result from one of two directions: being able to affect and possibly influence an organisation or, conversely, being influenced by it.

Any engagement with an organisation in whom a stake is held may be voluntary or involuntary in nature.

*********

Importance of identifying all stakeholders

Knowledge of the stakeholders is important for a number of reasons.

1. This will involve surveying stakeholders that can either affect or be affected by company’s project. Stakeholders in the company’s project include the local government authority, the local residents, the environmental group, the local school and the customers.

2. Stakeholder identification is necessary to gain an understanding of the sources of risks and disruption. Some external stakeholders, such as the local government authority, offer a risk to the project and knowledge of the nature of the claim made upon the company by the stakeholder will be important in risk assessment.

3. Stakeholder identification is important in terms of assessing the sources of influence over the objectives and outcomes for the project (such as identified in the Mendelow model). In strategic analysis, stakeholder influence is assessed in terms of each stakeholder’s power and interest, with higher power and higher interest combining to generate the highest influence.

4. It is necessary in order to identify areas of conflict and tension between stakeholders, especially relevant when it is likely that stakeholders of influence will be in disagreement over the outcomes for the project.

5. There is a moral case for knowledge of how decisions affect people both inside the organisation or externally.

********

There are a number of definitions of a stakeholder. Freeman (1984), for example, defined a stakeholder in terms of any organisation or person that can affect or be affected by the policies or activities of an entity. Hence stakeholding can result from one of two directions: being able to affect and possibly influence an organisation or, conversely, being influenced by it.

Any engagement with an organisation in whom a stake is held may be voluntary or involuntary in nature.

*********

Importance of identifying all stakeholders

Knowledge of the stakeholders is important for a number of reasons.

1. This will involve surveying stakeholders that can either affect or be affected by company’s project. Stakeholders in the company’s project include the local government authority, the local residents, the environmental group, the local school and the customers.

2. Stakeholder identification is necessary to gain an understanding of the sources of risks and disruption. Some external stakeholders, such as the local government authority, offer a risk to the project and knowledge of the nature of the claim made upon the company by the stakeholder will be important in risk assessment.

3. Stakeholder identification is important in terms of assessing the sources of influence over the objectives and outcomes for the project (such as identified in the Mendelow model). In strategic analysis, stakeholder influence is assessed in terms of each stakeholder’s power and interest, with higher power and higher interest combining to generate the highest influence.

4. It is necessary in order to identify areas of conflict and tension between stakeholders, especially relevant when it is likely that stakeholders of influence will be in disagreement over the outcomes for the project.

5. There is a moral case for knowledge of how decisions affect people both inside the organisation or externally.

********

Kohlberg’s Cognitive Moral Development Theories

Kohlberg’s cognitive moral development theories relate to the thought processes people go through when making ethical decisions.

Three Kohlberg levels

(1) Pre-conventional Level

At the preconventional level of moral reasoning, morality is conceived of in terms of rewards, punishments and instrumental motivations. Those demonstrating intolerance of regulations in preference for self-serving motives are typical preconventionalists.

Stage 1

Individual will see ethical decisions in terms of the rewards and punishments that will result:

• How will I be rewarded if I do this?

• What punishment will I suffer if I do this?

Stage 2

Individual will see ethical decisions in the more complex terms of acting in their own best interests. They will see decision in terms of the deals they can make and whether these deals are fair for them. For example it can mean helping others when others appear over-worked, but in return expecting others to help them when the situation is reversed.

(2) Conventional Level

At the conventional level, morality is understood in terms of ompliance with either or both of peer pressure/social expectations or regulations, laws and guidelines. A high degree of compliance is assumed to be a highly moral position.

Stage 3

Individual learning to live up to what is expected of them by their immediate circle (friends, workmates or even close competitors). An individual might feel pressured into staying out for a long lunch because everybody else in his team does. On the other hand the individual may feel he has to be at work by a certain time because everybody else is, even if it is earlier than their prescribed hours.

Stage 4

The individual operates in line with social cultural accord rather than just the opinion of those around them. This certainly means complying with the law as it codifies social accord. Stage 4 reasoning underlies most behaviour by accountants, as they comply with financial reporting and corporate governance requirements.

(3) Post-conventioanl Level

At the postconventional level, morality is understood in terms of conformance with ‘higher’ or ‘universal’ ethical principles. Postconventional assumptions often challenge existing regulatory regimes and social norms and so postconventional behaviour is often costly in personal terms.

Stage 5

What Individuals believe to be right is in terms of the basic values of their society, including ideas of mutual self-interest and the welfare of others. For example, is it right to charge interest?

Stage 6

Individuals base their decisions on wider universal ethical principles such as justice, equity or rights. It also means respecting the demands of individuals consciences. Business decisions made on these grounds could be disclosure on grounds of right-to-know that isn’t compelled by law, or stopping purchasing from suppliers who test products on animals, on the grounds that animal rights to be free from suffering should be respected. Using stage 6 reasoning may involve a personal cost, since it may mean failing to comply with existing social norms and regulations as they are seen as unethical.

Level 1: Preconventional level

Stage/Plane 1: Punishment-obedience orientation

Stage/Plane 2: Instrumental relativist orientation

Level 2: Conventional level

Stage/Plane 3: Good boy-nice girl orientation

Stage/Plane 4: Law and order orientation

Level 3: Postconventional level

Stage/Plane 5: Social contract orientation

Stage/Plane 6: Universal ethical principle orientation

**********

Three Kohlberg levels

(1) Pre-conventional Level

At the preconventional level of moral reasoning, morality is conceived of in terms of rewards, punishments and instrumental motivations. Those demonstrating intolerance of regulations in preference for self-serving motives are typical preconventionalists.

Stage 1

Individual will see ethical decisions in terms of the rewards and punishments that will result:

• How will I be rewarded if I do this?

• What punishment will I suffer if I do this?

Stage 2

Individual will see ethical decisions in the more complex terms of acting in their own best interests. They will see decision in terms of the deals they can make and whether these deals are fair for them. For example it can mean helping others when others appear over-worked, but in return expecting others to help them when the situation is reversed.

(2) Conventional Level

At the conventional level, morality is understood in terms of ompliance with either or both of peer pressure/social expectations or regulations, laws and guidelines. A high degree of compliance is assumed to be a highly moral position.

Stage 3

Individual learning to live up to what is expected of them by their immediate circle (friends, workmates or even close competitors). An individual might feel pressured into staying out for a long lunch because everybody else in his team does. On the other hand the individual may feel he has to be at work by a certain time because everybody else is, even if it is earlier than their prescribed hours.

Stage 4

The individual operates in line with social cultural accord rather than just the opinion of those around them. This certainly means complying with the law as it codifies social accord. Stage 4 reasoning underlies most behaviour by accountants, as they comply with financial reporting and corporate governance requirements.

(3) Post-conventioanl Level

At the postconventional level, morality is understood in terms of conformance with ‘higher’ or ‘universal’ ethical principles. Postconventional assumptions often challenge existing regulatory regimes and social norms and so postconventional behaviour is often costly in personal terms.

Stage 5

What Individuals believe to be right is in terms of the basic values of their society, including ideas of mutual self-interest and the welfare of others. For example, is it right to charge interest?

Stage 6

Individuals base their decisions on wider universal ethical principles such as justice, equity or rights. It also means respecting the demands of individuals consciences. Business decisions made on these grounds could be disclosure on grounds of right-to-know that isn’t compelled by law, or stopping purchasing from suppliers who test products on animals, on the grounds that animal rights to be free from suffering should be respected. Using stage 6 reasoning may involve a personal cost, since it may mean failing to comply with existing social norms and regulations as they are seen as unethical.

Level 1: Preconventional level

Stage/Plane 1: Punishment-obedience orientation

Stage/Plane 2: Instrumental relativist orientation

Level 2: Conventional level

Stage/Plane 3: Good boy-nice girl orientation

Stage/Plane 4: Law and order orientation

Level 3: Postconventional level

Stage/Plane 5: Social contract orientation

Stage/Plane 6: Universal ethical principle orientation

**********

Professionalism and Public Interest

Public Interest is the collective well-being of the community of people and institutions the professional accountant serves, including clients, lenders, governments, employers, employees, investors, the business and financial community and others who rely on the work of professional accountants. (IFAC)

Professionalism means avoiding actions that bring discredit on the accountancy profession.

Professional behavior imposes an obligation on professional accountants to comply with relevant laws and regulations.

Professionalism means to:

• Maintain confidentiality and upholding ethical standards.

• Should avoid making exaggerated claims for their own services, qualifications and experience

• Dealing with professional colleagues - work well with other team members, deal appropriately with concerns they raise about the work they are doing. They set an example to junior staff.

***********

Professionalism means avoiding actions that bring discredit on the accountancy profession.

Professional behavior imposes an obligation on professional accountants to comply with relevant laws and regulations.

Professionalism means to:

• Maintain confidentiality and upholding ethical standards.

• Should avoid making exaggerated claims for their own services, qualifications and experience

• Dealing with professional colleagues - work well with other team members, deal appropriately with concerns they raise about the work they are doing. They set an example to junior staff.

***********

Public Interest in accounting profession

Public interest is the collective wellbeing of the community of people and institutions that the professional accountant serves, including the business and financial community and others who rely on the work of professional accountants.

Trust is a key issue in terms of the public interest as it relates to accountants. The working of capital markets depends upon reliable financial information, as does business decision-making affecting jobs and supply. The public has to be able to believe that accountants’ opinions are give on a basis of sufficient work and that they are unaffected by external pressures.

Accountants who provide audit or assurance services must be able to demonstrate clearly their detachment from the client. They cannot do this if they are providing other services to the client.

*******

Professional Codes

Limitation of Professional Codes

1. Treatment as Rules

Because they contain descriptions of situations that accountants might encounter, they can convey the (false) impression that professional ethics can be reduced to a set of rules contained in a code. This would be a mistaken impression, of course, as the need for personal integrity is also emphasised.

2. Cannot cover all circumstances

Ethical codes do not and cannot capture all ethical circumstances and dilemmas that a professional accountant will encounter in his or her career and this reinforces the need for accountants to understand the underlying ethical principles of probity, integrity, openness, transparency and fairness.

3. Regional differences

Although codes such as IFAC’s are intended to apply to an international ‘audience’, some may argue that regional variations in cultural, social and ethical norms mean that such codes cannot capture important differences in emphasis in some parts of the world. The oral ‘right’ can be prescribed in every situation.

4. Legal enforcement

Finally, professional codes of ethics are not technically enforceable in any legal manner although sanctions exist for gross breach of the code in some jurisdictions. Individual observance of ethical codes is effectively voluntary in most circumstances.

******************

Usefulness of Professional Codes

1 Fundamental Principles

Firstly, professional codes of ethics signal the importance, to accountants, of ethics and acting in the public interest in the professional accounting environment. They are reminded, unambiguously and in ‘black and white’ for example, that as with other professions, accounting exists to serve the public good and public support for the profession is likely to exist only as long as the public interest is supported over and above competing interests.

2. Internally expected standards

The major international codes (such as IFAC) underpin national and regional cultures with internationally expected standards that, the codes insist, supersede any national ethical nuances. The IFAC (2003) code states (in clause 4), “the accountancy profession throughout the world operates in an environment with different cultures and regulatory requirements. The basic intent of the Code, however, should always be respected.”

3. Minimum Standard

The codes prescribe minimum standards of behaviour expected in given situations and give specific examples of potentially problematic areas in accounting practice. In such situations, the codes make the preferred course of action unambiguous.

4. Building confidence in the profession

A number of codes of ethics exist for professional accountants. Prominent among these is the IFAC code. This places the public interest at the heart of the ethical conduct of accountants. The ACCA code discusses ethics from within a principles-based perspective. Other countries’ own professional accounting bodies have issued their own codes of ethics in the belief that they may better describe the ethical situations in those countries.

**********

1. Treatment as Rules

Because they contain descriptions of situations that accountants might encounter, they can convey the (false) impression that professional ethics can be reduced to a set of rules contained in a code. This would be a mistaken impression, of course, as the need for personal integrity is also emphasised.

2. Cannot cover all circumstances

Ethical codes do not and cannot capture all ethical circumstances and dilemmas that a professional accountant will encounter in his or her career and this reinforces the need for accountants to understand the underlying ethical principles of probity, integrity, openness, transparency and fairness.

3. Regional differences

Although codes such as IFAC’s are intended to apply to an international ‘audience’, some may argue that regional variations in cultural, social and ethical norms mean that such codes cannot capture important differences in emphasis in some parts of the world. The oral ‘right’ can be prescribed in every situation.

4. Legal enforcement

Finally, professional codes of ethics are not technically enforceable in any legal manner although sanctions exist for gross breach of the code in some jurisdictions. Individual observance of ethical codes is effectively voluntary in most circumstances.

******************

Usefulness of Professional Codes

1 Fundamental Principles

Firstly, professional codes of ethics signal the importance, to accountants, of ethics and acting in the public interest in the professional accounting environment. They are reminded, unambiguously and in ‘black and white’ for example, that as with other professions, accounting exists to serve the public good and public support for the profession is likely to exist only as long as the public interest is supported over and above competing interests.

2. Internally expected standards

The major international codes (such as IFAC) underpin national and regional cultures with internationally expected standards that, the codes insist, supersede any national ethical nuances. The IFAC (2003) code states (in clause 4), “the accountancy profession throughout the world operates in an environment with different cultures and regulatory requirements. The basic intent of the Code, however, should always be respected.”

3. Minimum Standard

The codes prescribe minimum standards of behaviour expected in given situations and give specific examples of potentially problematic areas in accounting practice. In such situations, the codes make the preferred course of action unambiguous.

4. Building confidence in the profession

A number of codes of ethics exist for professional accountants. Prominent among these is the IFAC code. This places the public interest at the heart of the ethical conduct of accountants. The ACCA code discusses ethics from within a principles-based perspective. Other countries’ own professional accounting bodies have issued their own codes of ethics in the belief that they may better describe the ethical situations in those countries.

**********

Integrity

The IFAC code of ethics (2005) s.110.1 explains integrity as follows:

The principle of integrity imposes an obligation on all professional accountants to be straightforward and honest in professional and business relationships. Integrity also implies fair dealing and truthfulness.

Integrity is therefore a steadfast adherence to strict ethical standards despite any other pressures to act otherwise. Integrity describes the personal ethical position of the highest standards of professionalism and probity. It is an underlying and underpinning principle of corporate governance and it is required that all those representing shareholder interests in agency relationships both possess and exercise absolute integrity at all times.

In terms of professional relationships, integrity is important for the following reasons:

Reliability

It provides assurance to colleagues of good intentions and truthfulness. It goes beyond any codes of professional behaviour and describes a set of character traits that mean a person of integrity can be trusted. For auditors such as Potto Sinter, integrity means not only observing the highest standards of professional behaviour but also maintaining the appearance of integrity to his own staff and also to the client.

Efficiency and Effectiveness

It reduces time and energy spent in monitoring when integrity and openness can be assumed (the opposite of an audit situation where the professional scepticism should be exercised). Costs will be incurred by Miller Dundas if colleagues feel that Potto Sinter is untrustworthy.

Promotion of control environment

It cultivates good working relationships in professional situations. It encourages a culture of mutual support that can have a beneficial effect on organisational effectiveness. John Wang’s professional relationship with Potto is very important to Miller Dundas. It is important, therefore, that Potto has personal integrity.

**************

Five types of Ethical Threats

(a) Self-interest

Self-interest means the accountant’s own interest being affected by the success of the client, or the continuation of the accountant-client relationship. An example would be a financial interest in a client.

If a firm providing audit and other services disagrees with the client over the accounts that it is auditing, it faces the risk of not just losing the income from the audit, but perhaps also the much greater income from providing other services.

(b) Self-review

Self-review means the accountants auditing or reviewing work that they themselves have prepared. This could include auditing work that has been prepared as part of a non-audit service, something that prompts the suggestion that firm should not provide more than one service to a client.

If the accountants provide other services that materially affect the content of the accounts, then they will have to audit figures that they themselves have prepared, for example valuations.

(c) Advocacy

Advocacy means strongly promoting the interests of the accountants’ clients and undermining the accountants’ objectivity. Accountants can be seen as acting in the clients’, rather than the public interest.

If an accountant provides legal advice to his audit client. There are two problems. Firstly providing that advice could be seen as promoting the client’s interests rather than the public interest. Secondly the accounts may need to contain provision for, or disclosure about, legal actions. This will depend on the likelihood of the success of legal action, which could in turn depend on the advice the accountant had given. Therefore there is a clear possibility of the accountant not wishing to undermine the advice he has given by taking a prudent view of the issues’ treatment in the accounts.

(d) Familiarity

Familiarity means dealing with a client’s affairs for a long time and developing a close relationship. This can lead to reliance on previous knowledge rather than a questioning approach to information supplied.

Friendships with clients may make it more likely that clients would listen to the accountant’s advice; critics, however, suggest the friendships meant that he placed excessive trust in what he was told, and would be unwilling to raise awkward issues that could jeopardize the friendships. The provision of other services may mean that accountants are less rigorous in auditing information with which their firm has been involved.

(e) Intimidation

Intimidation means conduct of the assignment or conduct towards the client being influenced by pressure exerted by the client.

This could mean that if the client wished to intimidate the accountant into giving advice that they wanted to hear, they would have a good idea of how to do so, by for example threatening to replace the firm as auditors.

*************

Deontology and Consequentialism

Deontological ethics

The deontological perspective can be broadly understood in terms of ‘means’ being more important than ‘ends’. It is broadly based on Kantian (categorical imperative) ethics. The rightness of an action is judged by its intrinsic virtue and thus morality is seen as absolute and not situational. An action is right if it would, by its general adoption, be of net benefit to society. Lying, for example, is deemed to be ethically wrong because lying, if adopted in all situations, would lead to the deterioration of society.

Consequentialist ethics

The consequentialist or teleological perspective is based on utilitarian or egoist ethics meaning that the rightness of an action is judged by the quality of the outcome.

From the egoist perspective, the quality of the outcome refers to the individual (“what is best for me?”). Utilitarianism measures the quality of outcome in terms of the greatest happiness of the greatest number (“what is best for the majority?”). Consequentialist ethics are therefore situational and contingent, and not absolute.

**********

Company Codes of Ethics

Purposes of codes of ethics

1. To convey the ethical values of the company to interested audiences including employees, customers, communities and shareholders.

2. To control unethical practice within the organisation by placing limits on behaviour and prescribing behaviour in given situation.

3. To be a stimulant to improved ethical behaviour in the organisation by insisting on full compliance with the code.

************

Contents of a corporate code of ethics

The typical contents are as follows:

(A) Values of the company

This might include notes on the strategic purpose of the organisation and any underlying beliefs, values, assumptions or principles. Values may be expressed in terms of social environmental perspectives and expressions of intent regarding compliance with best practice, etc.

(B) Shareholders and suppliers of finance

In particular, how the company views the importance of sources of finances, how it intends to communicate with them and any indications of how they will be treated in terms of transparency, truthfulness and honesty.

(C) Employees

Policies towards employees, which might include equal opportunities policies, training and development, recruitment, retention and removal of staff.

(D) Community and wider society

The manner in which the company aims to relate to a range of stakeholders with whom it does not have a direct economic relationship (eg neighbours, opinion formers, pressure groups etc).

It might include undertakings on consultation, ‘listening’. Seeking consent, partnership arrangements (eg in community relationships with local schools) and similar.

(E) Supply chain/suppliers

This is becoming important as stakeholders scrutinise where and how companies source their products (eg farming practice, GM foods, fair trade issues etc).

Ethical policy on supply chain might include undertakings to buy from certain approved suppliers only, to buy only above a certain level of quality, to engage constructively with suppliers (eg for product development purposes) or not to buy from suppliers who do not meet with their own ethical standards.

(F) Customers

How the company intends to treat its customers, typically in terms of policy of customer satisfaction, product mix, product quality, product information and complaints procedure.

********

1. To convey the ethical values of the company to interested audiences including employees, customers, communities and shareholders.

2. To control unethical practice within the organisation by placing limits on behaviour and prescribing behaviour in given situation.

3. To be a stimulant to improved ethical behaviour in the organisation by insisting on full compliance with the code.

************

Contents of a corporate code of ethics

The typical contents are as follows:

(A) Values of the company

This might include notes on the strategic purpose of the organisation and any underlying beliefs, values, assumptions or principles. Values may be expressed in terms of social environmental perspectives and expressions of intent regarding compliance with best practice, etc.

(B) Shareholders and suppliers of finance

In particular, how the company views the importance of sources of finances, how it intends to communicate with them and any indications of how they will be treated in terms of transparency, truthfulness and honesty.

(C) Employees

Policies towards employees, which might include equal opportunities policies, training and development, recruitment, retention and removal of staff.

(D) Community and wider society

The manner in which the company aims to relate to a range of stakeholders with whom it does not have a direct economic relationship (eg neighbours, opinion formers, pressure groups etc).

It might include undertakings on consultation, ‘listening’. Seeking consent, partnership arrangements (eg in community relationships with local schools) and similar.

(E) Supply chain/suppliers

This is becoming important as stakeholders scrutinise where and how companies source their products (eg farming practice, GM foods, fair trade issues etc).

Ethical policy on supply chain might include undertakings to buy from certain approved suppliers only, to buy only above a certain level of quality, to engage constructively with suppliers (eg for product development purposes) or not to buy from suppliers who do not meet with their own ethical standards.

(F) Customers

How the company intends to treat its customers, typically in terms of policy of customer satisfaction, product mix, product quality, product information and complaints procedure.

********

Thursday, August 11, 2011

Public Interest, Professionalism

Public Interest is the collective well-being of the community of people and institutions the professional accountant serves, including clients, lenders, governments, employers, employees, investors, the business and financial community and others who rely on the work of professional accountants. (IFAC)

Professionalism means avoiding actions that bring discredit on the accountancy profession.

Professional behavior imposes an obligation on professional accountants to comply with relevant laws and regulations.

Professionalism means to:

**Maintain confidentiality and upholding ethical standards.

**Should avoid making exaggerated claims for their own services, qualifications and experience.

**Dealing with professional colleagues - work well with other team members, deal appropriately with concerns they raise about the work they are doing. They set an example to junior staff.

*******

Professionalism means avoiding actions that bring discredit on the accountancy profession.

Professional behavior imposes an obligation on professional accountants to comply with relevant laws and regulations.

Professionalism means to:

**Maintain confidentiality and upholding ethical standards.

**Should avoid making exaggerated claims for their own services, qualifications and experience.

**Dealing with professional colleagues - work well with other team members, deal appropriately with concerns they raise about the work they are doing. They set an example to junior staff.

*******

Accountancy Profession - Green Ecologist?

Accounting Profession in the light of Gray, Owen & Adam’s deep green (or deep ecologist) position on social responsibility

{Green Ecologist is a concept of social responsibility – Human beings have no greater rights to resources or life than any other species and do not have the rights to subjugate social and environmental systems. Economic systems that trade off threats to the existence of species against economic objectives are immoral. Arguably business cannot be trusted to maintain something as important as the environment. Existing economic systems are beyond repair as they are based on the wrong values, privileging humans over nonhumans. A full recognition of all stakeholders would mean that business had to be conducted in a completely different way. This viewpoint is connected with the ideas of sustainability.}

(1) Economic Priority

If accountants serve the economic interests of clients, then their priorities are fundamentally flawed. The deep ecologist perspective argues that giving the economic objectives of capitalists any priority over social and environmental degradation is immoral.

(2) Environmental degradation

Environmental degradation links to the deep ecologist view that business must not threaten the habitats of other species or worsen the living conditions of humans affected by their activities.

(3) Animal rights

The emphasis on the need for accountants to address animal rights is an important distinction between the deep ecologist and other positions, as it places animal rights on an equal plane with humans.

(4) Poverty

The stress on making the relief of poverty and other social injustices a priority links in with the deep ecologist view that all humans, living and yet-to-be-born, are stakeholders in business. Businesses need to recognize the needs of all stakeholders rather than subjugating their requirements to the current economic interest of shareholders.

**********

{Green Ecologist is a concept of social responsibility – Human beings have no greater rights to resources or life than any other species and do not have the rights to subjugate social and environmental systems. Economic systems that trade off threats to the existence of species against economic objectives are immoral. Arguably business cannot be trusted to maintain something as important as the environment. Existing economic systems are beyond repair as they are based on the wrong values, privileging humans over nonhumans. A full recognition of all stakeholders would mean that business had to be conducted in a completely different way. This viewpoint is connected with the ideas of sustainability.}

(1) Economic Priority